The second-most watched football tournament in the world, the UEFA European Football Championship, which is held every four years, returned to the global stage from 14 June through 14 July. With the exception of Euro 2020, which was played across a host of countries from England to Azerbaijan, the sporting event is normally played in its entirety across one or two host nations. This year, Germany hosted the tournament – the first it has staged since the 2006 World Cup.

The tournament was spread over a variety of cities from traditional visitor markets, such as Berlin & Munich, to the lesser traveled, such as Dortmund.

— Source: STR

— Source: STR

The tournament was a boon for smaller markets

Average daily rate (ADR) in markets such as Dortmund skyrocketed during the tournament. The BVB Stadion Dortmund hosted six matches, including the England vs. Netherlands semifinal, which generated large spikes in revenue and occupancy. Dortmund showed a 30% increase in occupancy when looking at matchdays vs. non-matchdays between 1 June and 14 July. The market saw a staggering 118% occupancy jump for the semifinal between the Netherlands and England. Furthermore, room rates increased dramatically to EUR433 for the aforementioned match, compared to a low of EUR86 on 2 June and EUR73 the day after the game on the 12 June.

Leipzig was also one of the big winners, despite East Germany not being a traditional powerhouse of German football. The market saw a 27% difference between matchday and non-matchdays during the tournament, and the four games it hosted saw considerable ADR spikes, much like Dortmund. The largest increase came during the Netherlands vs. France group stage game with an average ADR of EUR256.

— Source: STR

— Source: STR

Traditional markets lagged slightly

Traditional tourist markets, such as Berlin and Munich, saw slight increases in both occupancy and ADR but did not see anywhere near the results of Dortmund and Leipzig. This is likely due to the displacement of “normal” demand, as tourists who would have visited in a normal year decided to avoid the bigger markets in anticipation of a mass of football fans. Munich and Berlin actually saw a drop off in occupancy on game days whilst seeing a rapid increase in ADR. The Slovenia vs. Serbia game saw close to a 140% increase in day-to-day comparison against 2023, with a minimal lift in occupancy.

Berlin saw much smaller ADR increases in day-to-day comparison with 2023, which hovered around the 50% mark before the final, but saw a 200% increase on the night of the championship. Berlin also suffered a drop in occupancy day to day compared with the same period in 2023.

— Source: STR

— Source: STR

Frankfurt and Düsseldorf in particular saw bigger spikes in ADR from conferences such as ACHEMA & DRUPA before the tournament than they did for any of the games they hosted. Frankfurt’s largest ADR spike came during the England vs Denmark match, which did not come close to the level generated in the market from ACHEMA.

— Source: STR

— Source: STR

— Source: STR

— Source: STR

Fans did not stick around

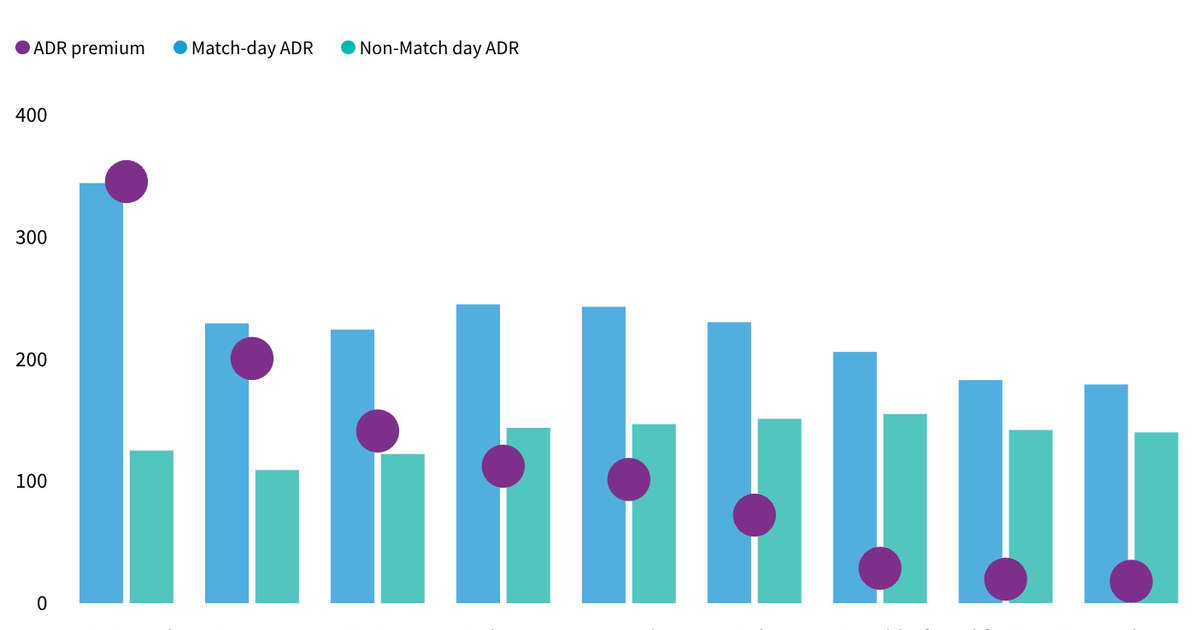

The data suggests that fans did not stick around for long in each city. Significant drops in room rates and occupancy the day after a match showed that stays were temporary and therefore did not bring the increased revenue to each host city in the same way that an Olympic city would benefit. The ADR premium shows, for example, that in Dortmund there was a 175% jump in the matchday level vs the non-matchday, with Berlin and Munich seeing jumps of 52% and 66%, respectively.

— Source: STR

— Source: STR

About STR

About STR

STR is the global leader in hospitality data benchmarking, analytics and marketplace insights. Founded in 1985, STR maintains a robust global presence with regional offices strategically located in Nashville, London, and Singapore. In October 2019, STR was acquired by CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information and analytics in the commercial and residential property markets. For more information, please visit str.com and costargroup.com.

View source