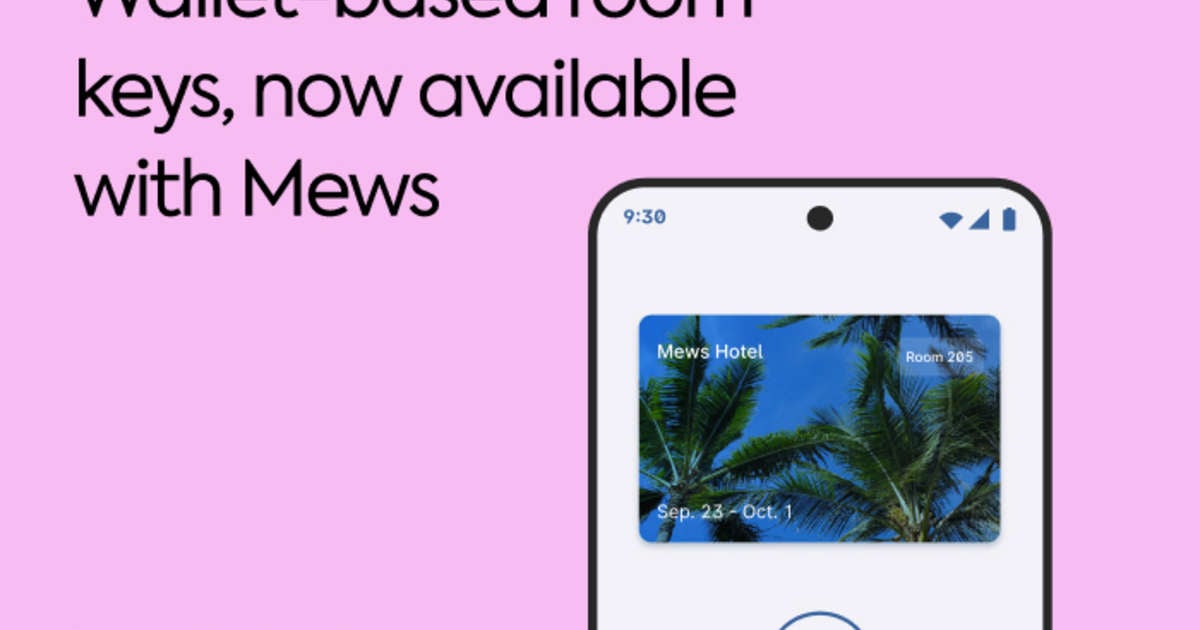

Nepal’s CG Hospitality targets a threefold jump in number of hotels to 650 hotels in its investment portfolio by 2030. Overly ambitious?

INTERNATIONAL REPORT – Nepalese Chaudhary Group has always dreamt big about its hotel venture undertaken by its subsidiary CG Hospitality.

It took billionaire Binod Chaudhary and his son, Rahul Chaudhary, almost 27 years to get to an investment portfolio comprising 195 hotels/12,000 keys across 12 countries, from a clutch of five properties in the Maldives, Sri Lanka and India.

Most of the properties are from Concept Hospitality, one of CG’s shrewdest hotel investments. In 2015, it became majority shareholder of the Mumbai-based firm by buying out the existing partner.

Concept, a smart, eco-minded Indian hotel management company founded in 1996 by accomplished hotelier Param Kannampilly, today boasts 120 operating hotels and 40 in the pipeline across India. Helmed by CEO and Managing Director Suhail Kannampilly, son of the founder, its star brand is The Fern Hotels & Resorts, comprising 84 open properties and 31 in pipeline, totaling 115 properties/8,000 rooms.

Signing of The Farm as Autograph Collection (from left): Rajan Uttamchandani, The Farm at San Benito; Rahul Chaudhary, CG Hospitality Global; Binod Chaudhary, CG Corp Global; Rajeev Menon, Marriott International; Peter Gassner, Marriott International

The rest of CG’s portfolio reflects the exuberance of a hospitality investor from a developing nation going on a learning curve. Its adventures have been far-flung, eclectic and diversified: a stake here, a joint venture or revenue sharing there; from Kenya to New York; with partners that include Taj, comprising 17 hotels/lodges, or single hotels under brands including Hilton, Radisson and Fairmont; and divestments that have included its stake in Alila at one point and InVision Thailand at another.

When asked how he wants CG Hospitality to be recognized, Rahul Chaudhary, managing director and CEO, told Hotel Investment Today, “As my father says, we used to be a small company from a small country with a big dream. We have been able to achieve, in our own modest and humble way, to be a one-stop shop. We are operators, investors/developers and asset managers. We would like to be known as an upcoming global growth player in the hospitality sector and I think we are getting there.”

The lynchpin

Concept has scale, thus is the lynchpin of CG’s latest growth target of 650 hotels/30,000 keys by 2030 – a threefold jump from now, and in mere five years.

“The vision is that we want to take [The Fern] to 500 hotels by 2030, and CG Hospitality to 600-650 hotels,” Chaudhary said.

Lakan Villa at The Farm at San Benito

Such targets may appear overly ambitious to skeptics, but Chaudhary is betting on Concept’s newly-signed deal affiliating The Fern to Marriott International to herd massive numbers of new guests – hence more third-party owners – towards The Fern properties.

“Without Marriott, I would say we [The Fern] would continue to grow, but to the extent of 500 hotels would not be easy. But now, I’m confident we will be able to get there,” Chaudhary said, praising Marriott’s distribution system and loyalty program, as well as the chain’s commitment in taking a small equity in Concept. Said to be Marriott’s first direct investment in India, the investment is speculated to be a 15% share in Concept at a valuation of $100 million.

Much larger play

The ultimate goal of CG is a listing in the next few years of either the holding company or individual brands such as The Fern or The Farm at San Benito in the Philippines, Chaudhary said.

The Chaudhary’s have always aspired to create a global wellness brand out of the single award-winning Farm at San Benito upon acquiring the shares of the resort from Avalon Hospitality in 2018.

The vision is that we want to take [The Fern] to 500 hotels by 2030, and CG Hospitality to 600-650 hotels.

Rahul Chaudhary

It appears to have found a partner for this dream in Marriott, signing a contract in May to integrate The Farm at San Benito into Marriott Autograph Collection by third quarter 2025.

According to the next-gen Chaudhary, “discussions are on-going with Marriott for a much larger play with Marriott to take [The Farm] brand global, starting with APAC and the Indian sub-continent, then moving on to other parts of the world.”

He added, “Marriott itself believes that this space is very interesting and I don’t think it has a wellness brand presently.”

Marriott does not have a standalone wellness brand per se, but wellness is a core element integrated into several of its brands, especially JW Marriott and Westin.

The Farm at San Benito in the Philippines was founded in 2002 by German expatriate Eckard Rempe. The story goes that Binod Chaudhary, chairman of CG Corp Global, visited the resort as a wellness traveler and upon finding the experience life-changing, returned as its owner.

Other CG opportunities

The bromance with Marriott does not mean existing or future partners will be sidelined. Apart from growing The Fern and The Farm, CG is continuing to look at acquiring hotel management companies and investing in developments in different parts of the world, including new frontiers and emerging markets, Chaudhary said.

“India is no longer the frontier market it was when we first entered the sub-continent with Taj, which remains a very important partner,” Chaudhary added. “India is our key focus, but there are also opportunities in frontier markets such as Bhutan, and emerging markets such as some countries in Southeast Asia.”

Not all international brands provide value to investors, especially when the market segment is domestic.

Mihir Thacker

He said the capital for acquisitions is from “our own hospitality vertical itself.”

Parent company CG Corp Global is Nepal’s only multi-billion-dollar conglomerate whose businesses include Fast-Moving Consumer Goods (FMCG), banking, power, hospitality, real estate, telecoms, cement and education.

Global face

So, can CG Hospitality be the global face of Nepal?

Said Mihir Thacker, principal consultant of Revitru, a Singapore-based advisory firm that specializes in real estate and hospitality projects across markets, “CG is an interesting firm that plays on all sides of the business; they’re an investor in hard assets with other investors, and JVs with operators on hard assets as well as operating platforms. This gives them a unique insight into all aspects and also operator performance as an investor with them, which is different from being merely an asset owner. The ability to invest across strategies is a key element of their success.

“However, at times, these can be conflicting in determining which side should one allocate capital into, how do potential partners view this and, equally important, what is the long-term end game to drive returns?

“Do part stakes in multiple platforms equate into meaningful valuations? At some point they may consider a consolidation to create financial value at an integrated platform level.”

On the Concept-Marriott deal, Thacker said it provides Marriott the chance to launch an economy conversion brand rapidly in India. But the jury is out on whether it will quicken the roll-out for The Fern.

“Investment in technology, safety compliance, governance, enhanced fees will be a reality. Can erstwhile Fern owners in the market segment that Fern attracts afford it? Will fees increase?” Thacker said.

“Not all international brands provide value to investors, especially when the market segment is domestic,” he added.

‘Don’t look back’

CG said all its investments are now in the green following a difficult pandemic period.

When asked to compare hotel asset class to other businesses, Chaudhary said, “My father always said the amount of time it takes to build a factory and breakeven by selling noodles is six months [CG Foods owns Wai Wai and other branded noodles]. Hotels have a long gestation period of almost five years. So, it’s a very ‘patient’ business. You have to be willing to stay on.”

He added, “I look at every hotel as a factory. Every factor needs to operate and churn. But what I find interesting about hotels is that they are all different with different cultures. How do we manage a diverse portfolio? We have regional headquarters in Nepal, India, Sri Lanka, UAE, Philippines, etc., and good people in these places with a passion for the business. If you have good people, the rest just follows.”

And the biggest lesson learned from his father? “Too many lessons,” he said, laughing. “But the biggest is that once you have decided to achieve something, or set a goal for yourself, no matter what, don’t look back, just look forward.”

His father does not get involved in the day-to-day running of CG, rather is more focused on strategy. Said the son, ”He’s the one who has driven the vision and growth for this business. We all share the dream and are all working on it.”